In the court opinion filed on Aug. 26, 2013, Judge Jay S. Bybee writes that the “alleged misrepresentations included exaggerated acreage reports, misidentifying the crop planted, incorrect planting dates, claiming non-irrigated crops were irrigated, misrepresenting forage crops as crops for grain production, and inventing causes of loss.”

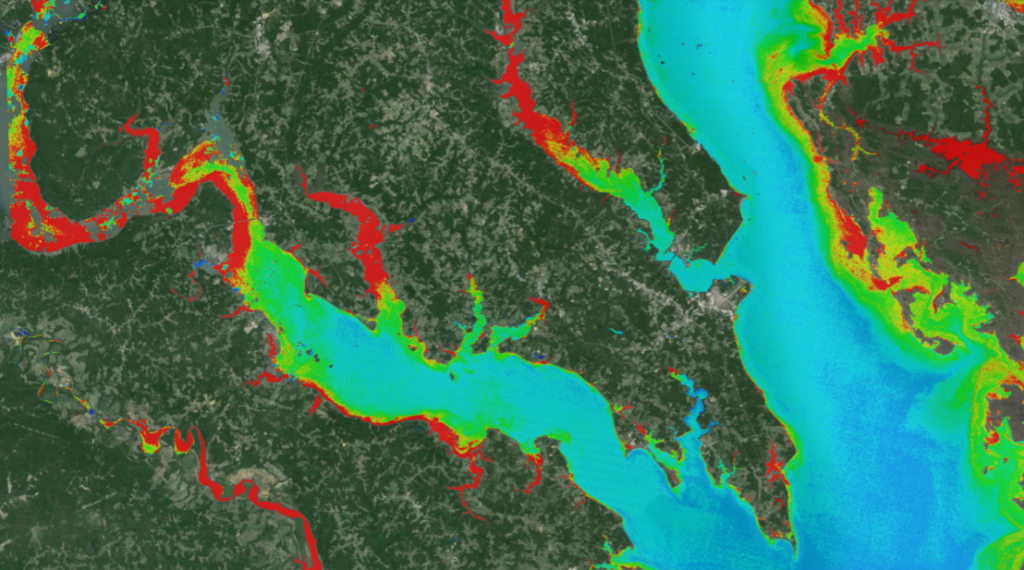

Satellite imagery, including Landsat data, was entered into evidence and proved that a number of claims for crop losses were false. Imagery showed that a 2001 claim filed for a failed wheat crop was bogus, because no wheat crop existed at that time that could have been damaged by hail, wind, and excessive rain as claimed. Satellite imagery also showed that another claim was unsubstantiated because there wasn’t enough land cleared for half the acreage claimed lost; and, in another instance, satellite imagery showed that fields reported to be planted with safflower were actual sown with corn and alfalfa.

Landsat imagery is especially useful for weeding out crop fraud because it is an unbiased source—anyone can download and use the data, it is regularly collected (every 8 to 16 days), reliably archived and made freely available (by USGS), and at a spatial resolution appropriate for looking at individual fields (30 m/pixel).

In late August, the USDA’s Risk Management Agency, which manages the Federal crop insurance program, was awarded for improving crop insurance compliance using a massive data mining and analytics system. The system inputs claim histories, weather data, and MODIS and Landsat satellite data to identify spurious claims.

A press release written by the analytics company that works with the Risk Management Agency (RMA), states: “Leveraging the power of integrated data, the RMA was able to gain deeper insights into claims and program expense thus achieving a cost avoidance of over $1.5 billion as scored by the Congressional Budget Office. Estimated reductions from prior year indemnities represent more than a $23 return for every dollar spent by RMA on data mining technology and projects. One initiative generated a list of producers who were subjected to increased compliance oversight; from 2001 to 2011, this reduced unneeded indemnity payments by approximately $838 million.”

Resources:

+ Opinion filed by Judge Bybee, Aug. 26, 2013

+ USDA Honored by The Data Warehousing Institute for Risk Management Using Teradata Analytics

+ Saving Millions in Government Dollars: Landsat Helps Fight Crop Insurance Fraud

Contributor: Laura E.P. Rocchio

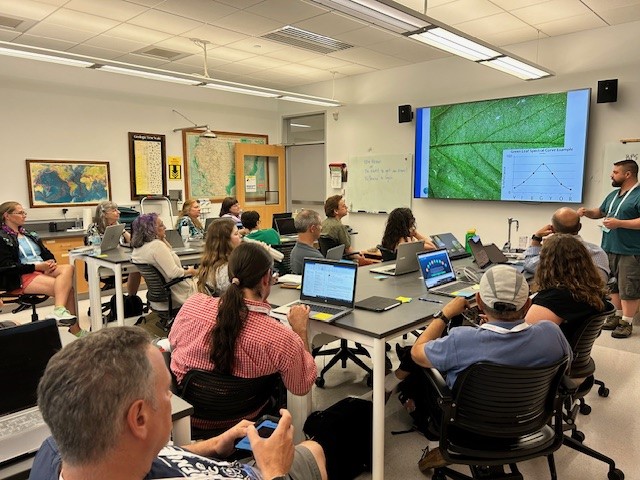

A Rendezvous with Landsat

NASA outreach specialists led educators through a workshop on accessing and utilizing Landsat data at the annual Earth Educators’ Rendezvous.